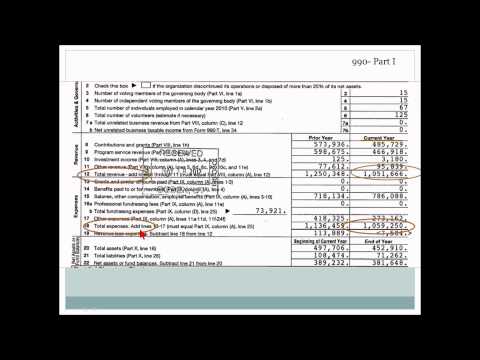

Welcome to the application of the San Francisco foundation. This application contains an expanded financial history section. This tutorial will help you navigate the fields and provide guidance on the data that we are requesting. The financial history section is a table in part one of the application. The foundation has provided a link to an Excel document that we recommend giving to your accounting or bookkeeping staff to complete. Then, transfer the numbers to the online application. The form also provides a series of calculations based on the financial history. We ask for comments on these calculations based on certain thresholds. Again, we ask that this section of the form is copied into the online application. This will provide the foundation with a summary of financial position and provide the opportunity for you, the applicant, to explain any variances in the annual data. The foundation has added comments to the form. If you click on the cells with their red squares, you will see notes about the definitions of each line item. This tutorial will use a 990 and an audit as examples of where to find financial data at your organization. You may need to use your accounting system to generate financial statements and use those reports to find the data. We recommend working with your accounting staff to ensure accuracy in the data. Because we recommend completing the Excel version of the file first and transferring the data to the online application, we will focus on the Excel document. The top of the form allows you to identify your grant number and organization name. Then, enter your organization's current organizational budget. Enter the grant amount you are requesting and the total project budget. If the grant is for core operating support, please leave this section blank. The income statement section of...

Award-winning PDF software

990-pf instructions 2025 Form: What You Should Know

Understanding Form 990-PF and the basics of the Form 990, 990-EZ, 990PF and Form 990-PF (2021) | How to file for 501(c)(3) status and pay IRS tax. Aug 12, 2025 — Download this step-by-step instructions for completing and filing IRS Form 990-PF and IRS Form 990-PF Instructions for Foreign Organizations. Sep 5, 2025 — Download this step-by-step instructions for completing IRS Form 990-PF and IRS Form 990-PF Instructions for Corporations. Dec 3, 2025 — View the 2025 Form 990-PF instructions. Dec 10, 2025 — Form 990PF instructions (2021) for the most recently published 2025 IRS Form 990.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 990-PF, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 990-PF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 990-PF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 990-PF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 990-pf instructions 2025